With the surge in online commerce, choosing the best payment gateway in India has become critical for success. This article aims to explore why Payomatix is emerging as a leader in the payments industry, offering unique solutions that cater to diverse business needs, and why it’s poised to be the best payment gateway in India.

Current Landscape of Payment Gateways in India

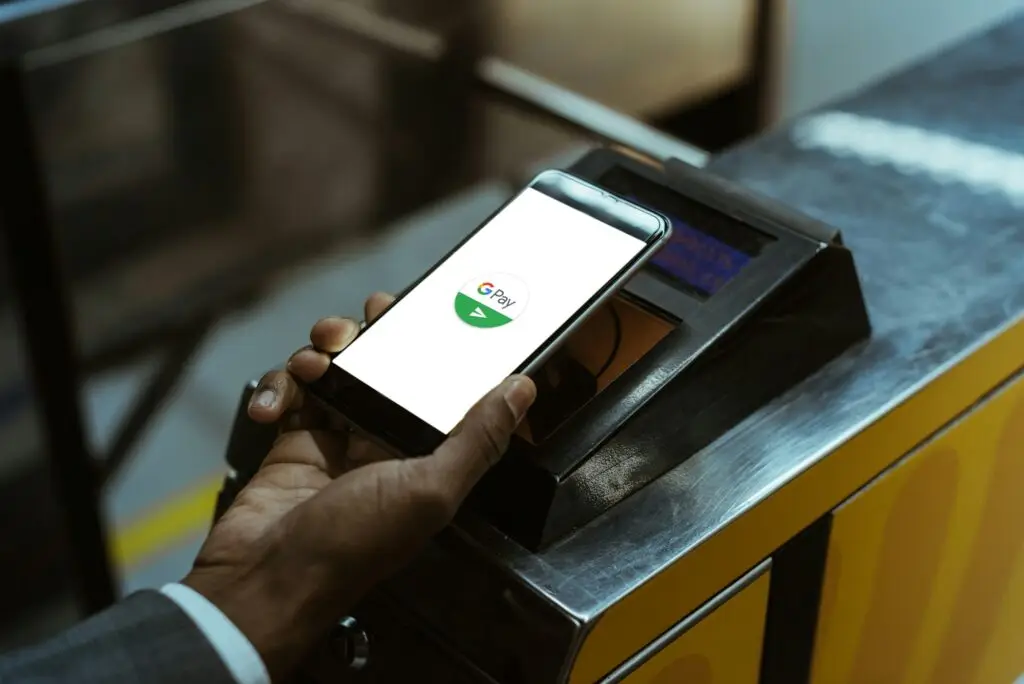

India has witnessed a rapid growth in digital payments, fueled by government initiatives, digital literacy, and an increasing preference for cashless transactions. As per recent reports, digital transactions in India are expected to surpass USD 10 trillion by 2026. This massive shift has intensified the competition among payment gateways in India, each vying for market share by offering various features like security, speed, lower transaction fees, and compatibility with multiple payment methods.

However, the diverse and complex needs of businesses mean that not all payment gateways are created equal. Businesses, particularly SMEs and startups, face several challenges in choosing the right payment gateway for their operations. Factors like high transaction fees, limited payment options, inadequate support for recurring payments, and lack of real-time settlement often become significant pain points.

Challenges and Opportunities in the Digital Payment Ecosystem

Despite the widespread adoption of digital payments, several challenges persist:

- High Transaction Costs: Most businesses are highly sensitive to the costs associated with each transaction. High fees can significantly impact the bottom line, especially for startups and small businesses.

- Security Concerns: With the rise in digital transactions, the risk of fraud has also escalated. Ensuring a secure transaction environment is a priority for both businesses and consumers.

- Integration Complexities: Many payment gateways have complex integration processes, making it difficult for businesses to implement them seamlessly within their existing platforms.

- Limited Support for Multiple Payment Methods: To cater to a diverse customer base, businesses need a payment gateway that supports multiple payment options, such as credit/debit cards, UPI, net banking, digital wallets, and international payments.

- Scalability Issues: As businesses grow, their payment processing needs also evolve. Many payment gateways do not offer scalable solutions, restricting a business’s ability to expand smoothly.

The Need for a Reliable Payment Gateway in India

To overcome these challenges, businesses need a reliable payment gateway that offers a comprehensive suite of features tailored to their unique needs. The ideal payment gateway should offer:

- Low Transaction Fees: Competitive pricing to ensure affordability.

- Robust Security: Advanced security features to prevent fraud.

- Easy Integration: Simple integration with existing platforms.

- Multi-Payment Support: Capability to handle multiple payment types.

- Real-Time Settlement: Quick fund transfer for improved cash flow.

- Scalability: Ability to grow with the business.

This is where Payomatix comes into the picture.

Payomatix: The Best Payment Gateway in India for Businesses

Payomatix is a cutting-edge payment gateway solution designed to simplify payment processing for businesses in India. Here’s why Payomatix is considered one of the best payment gateway options available:

1. Low Transaction Fees

Payomatix offers one of the most cost-effective payment processing solutions in India, with competitive pricing models that help businesses save significantly on transaction fees. With Payomatix, businesses can avoid exorbitant charges, ensuring more of their earnings are retained as profit.

2. Advanced Security Measures

Security is a top priority for Payomatix. The gateway utilizes robust encryption protocols, two-factor authentication (2FA), tokenization, and fraud detection algorithms to ensure the highest level of security for all transactions. This commitment to security helps businesses build trust with their customers, reducing the risk of fraud and chargebacks.

3. Seamless Integration with Multiple Platforms

Payomatix offers easy integration with major e-commerce platforms such as Shopify, WooCommerce, Magento, and others. The gateway provides developer-friendly APIs and plugins that allow for a hassle-free integration process, reducing downtime and increasing operational efficiency.

4. Supports Multiple Payment Methods

One of the key strengths of Payomatix is its ability to support a wide range of payment methods. Whether it’s UPI, credit/debit cards, net banking, digital wallets, or international transactions, Payomatix ensures that businesses can offer their customers the payment options they prefer. This flexibility is crucial in catering to a diverse customer base and enhancing conversion rates.

5. Real-Time Settlement for Better Cash Flow

Unlike many payment gateways that delay fund transfers, Payomatix offers real-time settlement options that help businesses maintain a healthy cash flow. This feature is particularly beneficial for startups and small businesses that need quick access to funds to manage their daily operations effectively.

6. Scalable Solutions for Growing Businesses

As businesses grow, so do their payment processing needs. Payomatix is designed to scale with businesses, offering advanced features like recurring payments, multi-currency support, and real-time analytics. This scalability makes it the ideal choice for businesses looking to expand without worrying about outgrowing their payment gateway.

7. Comprehensive Support and Reliability

Payomatix provides 24/7 customer support to help businesses with any issues that may arise during transactions. The payment gateway boasts a high uptime, ensuring reliable service that is crucial for business continuity.

Case Studies and Real-World Impact

To illustrate the impact of Payomatix, consider the case of an e-commerce startup that integrated Payomatix into its platform. By switching to Payomatix, the business reduced its transaction fees by 30%, increased its conversion rates by 15%, and saw a 50% reduction in checkout abandonment due to faster and more secure payment processing.

Similarly, a subscription-based service provider leveraged Payomatix’s recurring payment features to streamline its billing cycle, resulting in a 20% improvement in customer retention and reduced manual workload.

The Future of Digital Payments with Payomatix

As digital payments continue to grow in India, businesses will need to adopt more efficient and customer-friendly payment solutions to stay ahead of the competition. Payomatix is at the forefront of this transformation, providing innovative payment gateway solutions that cater to the unique needs of Indian businesses.

With features like low transaction fees, robust security, easy integration, support for multiple payment methods, real-time settlements, and scalability, Payomatix is redefining what it means to be the best payment gateway in India.

In the ever-evolving landscape of digital payments, choosing the right payment gateway can make or break a business. Payomatix offers a comprehensive solution that addresses the key challenges faced by businesses, providing a seamless and secure way to handle transactions. By integrating Payomatix, businesses can not only enhance their payment processes but also build a foundation for sustained growth and success.

To learn more about how Payomatix can revolutionize your business’s payment experience, visit our website or explore our white-label services.

Ready to take your business to the next level? Partner with Payomatix today and experience the best in digital payment solutions. Contact us now to get started!