Edit Content

Explore India’s first payment ecosystem that allows businesses to transact with multiple payment services and drive unlimited revenue digitally.

Explore India’s first payment ecosystem that allows businesses to transact with multiple payment services and drive unlimited revenue digitally.

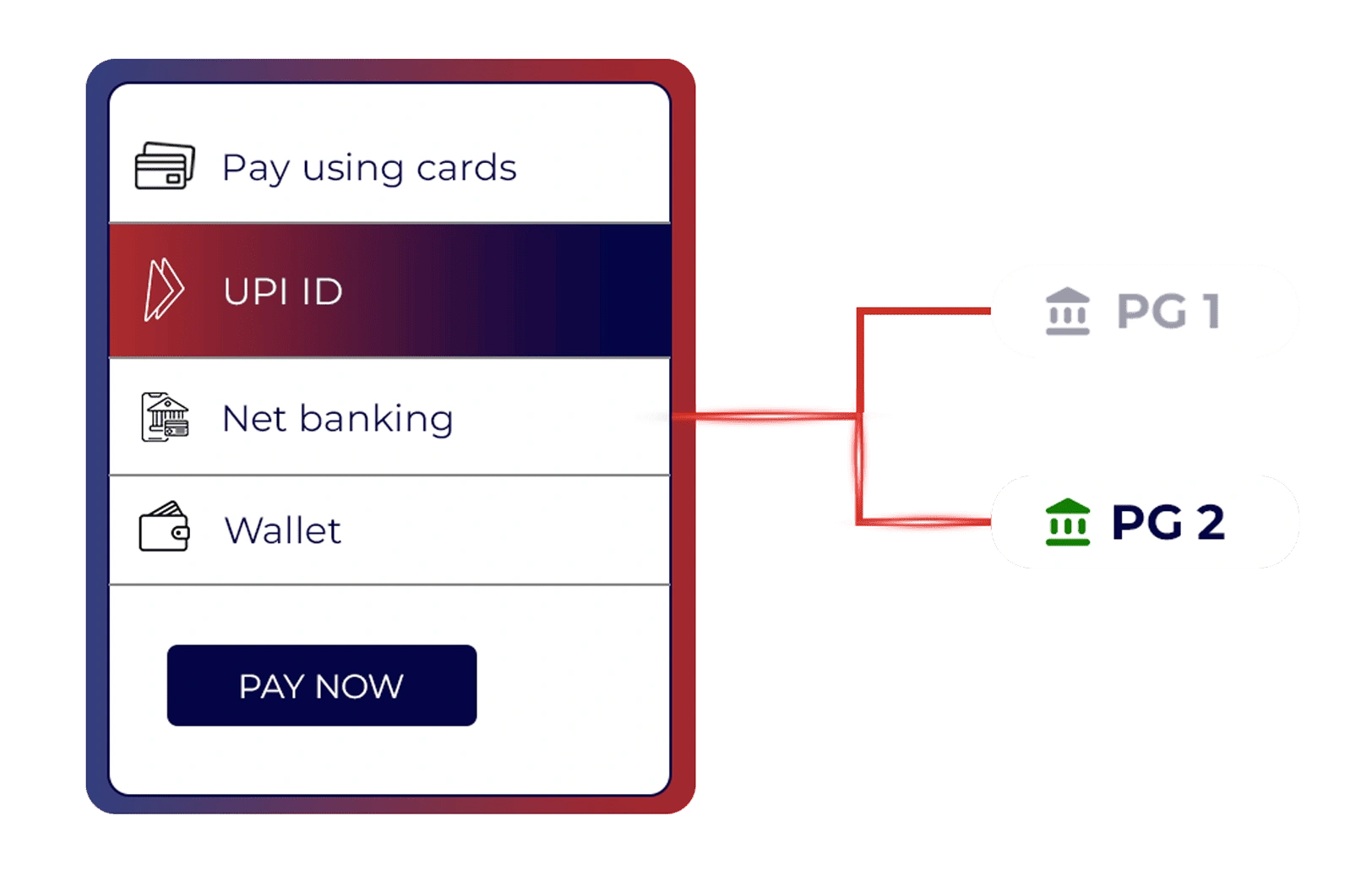

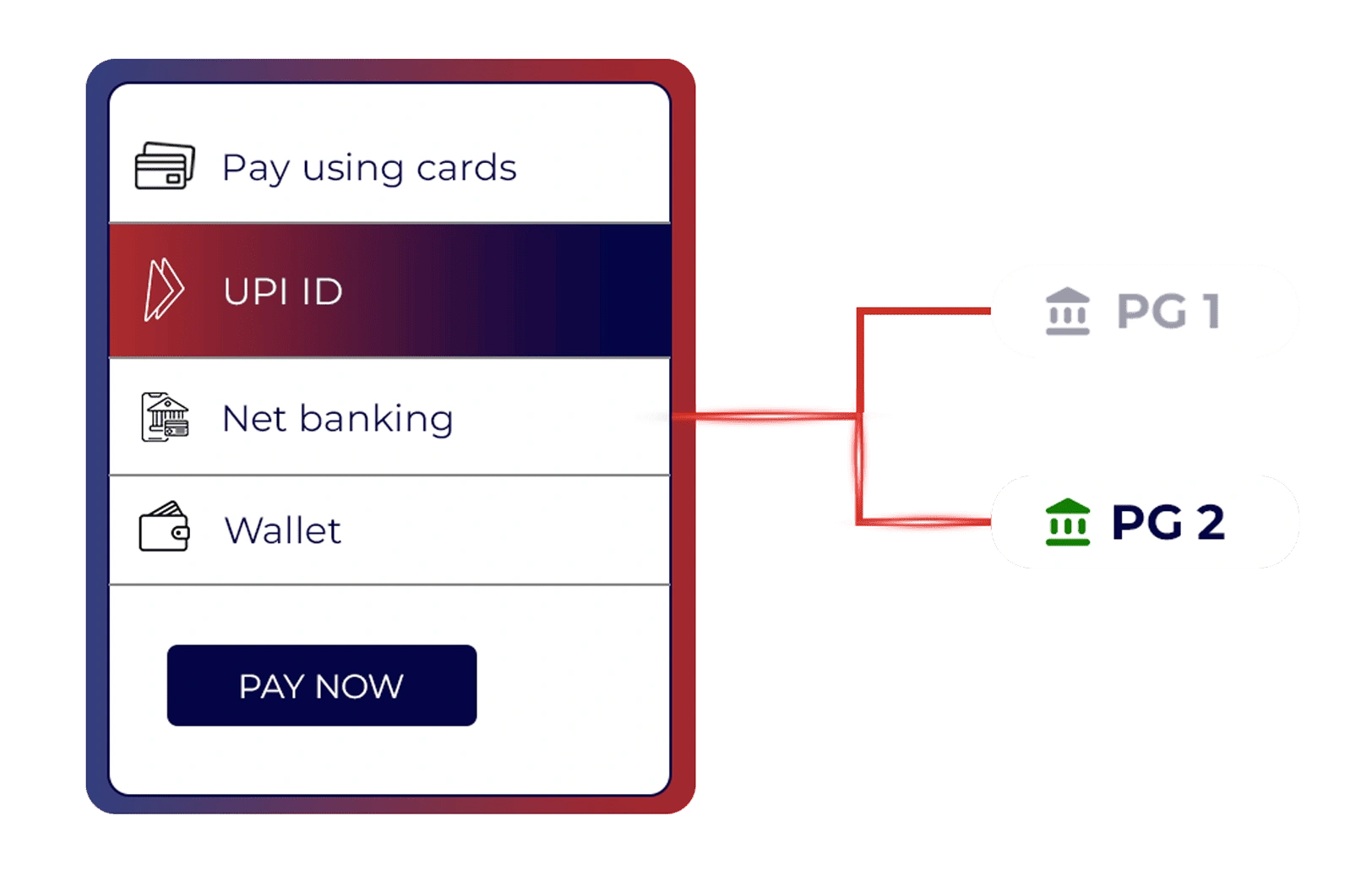

Payment orchestration allows businesses to route transactions dynamically across multiple payment providers, ensuring seamless payment processing without dependencies on a single gateway.

Payment Orchestration is a comprehensive payment management strategy that enables businesses to streamline payment processing across multiple providers, payment methods, and geographies.

By optimizing transactions in real-time, payment orchestration enhances efficiency, reduces operational costs, and improves customer experience.

For businesses operating across diverse markets, managing multiple payment gateways, acquirers, and processors can be complex. Payment orchestration simplifies this by automating transaction routing, failure management, and fraud prevention, ensuring seamless payment acceptance and higher conversion rates.

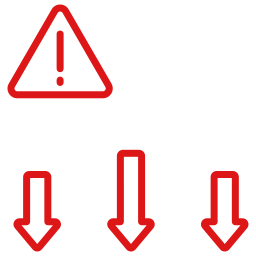

Businesses today face multiple payment-related challenges, including:

Customers abandoning purchases due to declined transactions.

Inability to support multiple local and global payment options.

Increased exposure to fraudulent transactions.

Managing multiple payment providers leads to inefficiencies.

Expanding into new markets without a flexible payment strategy.

Business Losing Revenues due to payment gateway downtime

Connect with top-tier payment providers.

Boost revenue by reducing failed payments.

Adheres to RBI, PCI-DSS, and GDPR regulations.

Designed for startups, and high-growth businesses.

Payment Orchestration is a comprehensive payment management strategy that enables businesses to streamline payment processing across multiple providers, payment methods, and geographies.

By optimizing transactions in real-time, payment orchestration enhances efficiency, reduces operational costs, and improves customer experience.

Businesses today face multiple payment-related challenges, including:

Customers abandoning purchases due to declined transactions.

Inability to support multiple local and global payment options.

Increased exposure to fraudulent transactions.

Managing multiple payment providers leads to inefficiencies.

Connect with top-tier payment providers.

Boost revenue by reducing failed payments.

Adheres to RBI, PCI-DSS, and GDPR regulations.

Designed for startups, and high-growth businesses.