Edit Content

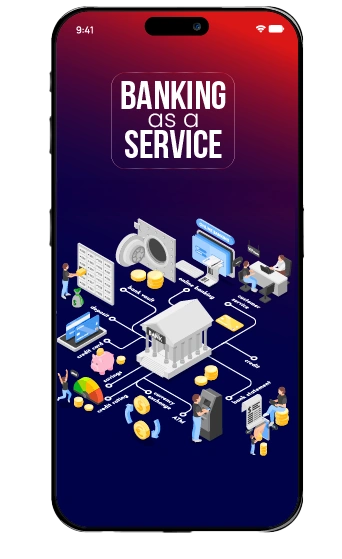

Explore India’s first payment ecosystem that allows businesses to transact with multiple payment services and drive unlimited revenue digitally.

Explore India’s first payment ecosystem that allows businesses to transact with multiple payment services and drive unlimited revenue digitally.

Payomatix BaaS solutions provide businesses with the infrastructure to integrate financial services seamlessly, enhancing customer engagement and driving revenue growth.

Businesses can launch financial products

without a banking license.

Eliminates the need for complex banking infrastructure and compliance handling.

Provides fully integrated, white-label financial solutions.

Ensures adherence to RBI, NPCI, PCI-DSS, and global financial regulations.

Launch full-fledged digital banking platforms.

Enable embedded payments & financing for buyers/sellers.

Automate worker payouts & earnings accounts.