Powering Smarter Payments

Secure, scalable, and AI-driven payment gateway solutions in India to enhance success rates and streamline online payment processing.

About

As a leading payment gateway provider in India, Payomatix delivers a comprehensive suite of services, including multi-channel payment processing, UPI solutions, payment orchestration, bulk payouts, and white-label systems. We empower businesses to accept payments effortlessly via credit/debit cards, UPI, net banking, wallets, and EMI options — all through a single, unified integration.

600+

Business have already joined us!

0%

Zero percent fee to any transaction.

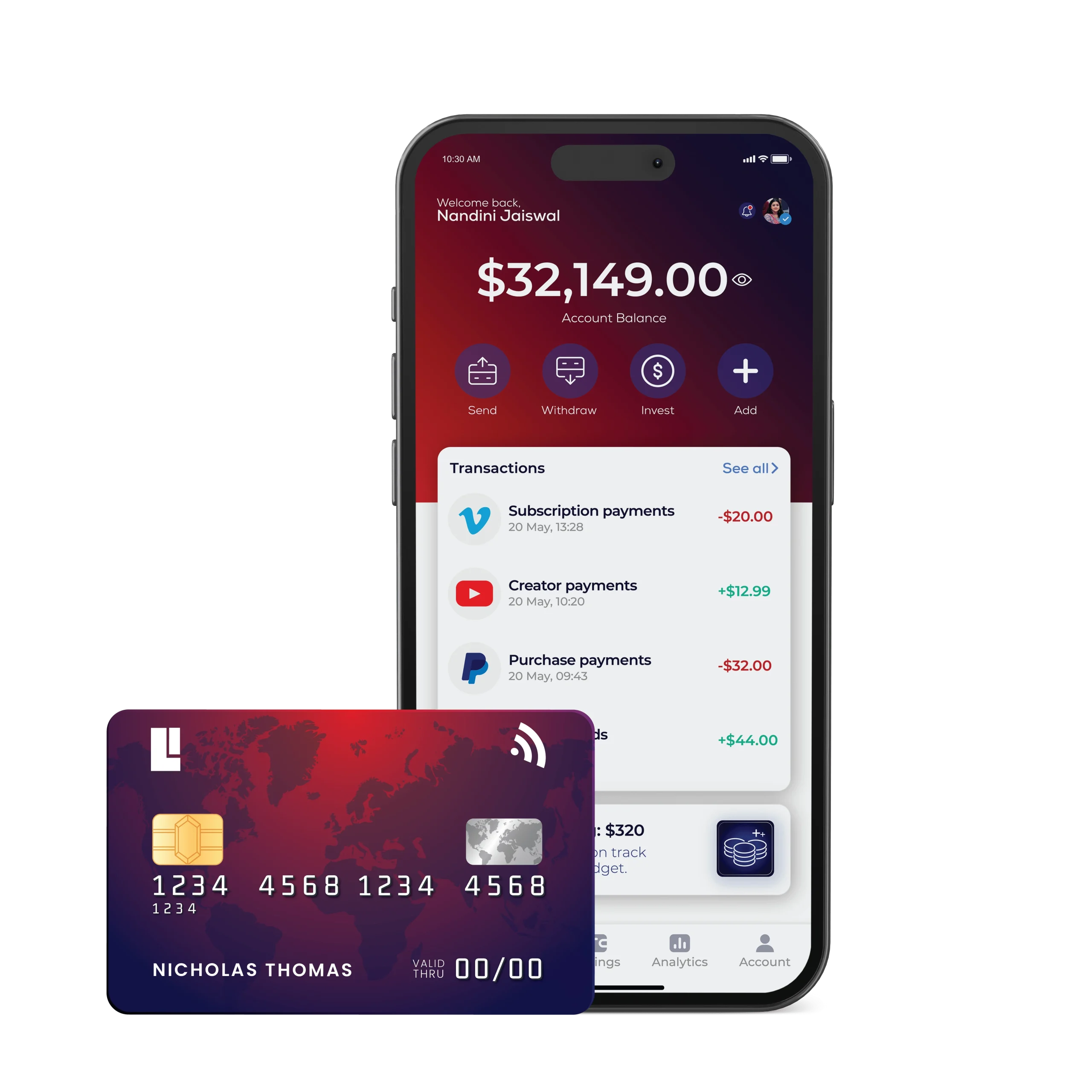

Payments Simplified

Unlocking the Power of Digital Payments

At Payomatix, we are revolutionizing the digital payments landscape by providing businesses with seamless, secure payment processing and scalable solutions that simplify transactions and drive growth.

Multiple Payment Methods

Smart Payment

Routing

Seamless

Integration

An API-first approach with no downtime, ensuring smooth and efficient payment gateway integration.

Our Solutions

Unified Payment Solutions Tailored for Your Business.

Payment Gateway

Accept seamless, secure payment processing via UPI, cards, net banking, and wallets with real-time processing.

Payment Orchestration

White-Label Services

Launch your own branded payment gateway with full customization and compliance.

Why Payomatix?

At Payomatix, we are revolutionizing the digital payments landscape by providing businesses with seamless, secure payment processing and scalable solutions. Our mission is to simplify transactions, enhance success rates, and empower businesses of all sizes with cutting-edge online payment infrastructure.

AI-driven Smart Routing technology

PCI-DSS

compliance

Backed by PCI-DSS compliance, RBI and NPCI regulations, and robust fraud detection mechanisms, Payomatix ensures secure payment processing with maximum security and reliability.

Replacing complexity with simplicity

At Payomatix, we believe that payments should be effortless, not overwhelming. That’s why we’ve built a unified, intelligent, and seamless omnichannel payment solution that removes complexities and makes transactions faster, smarter, and more efficient.

Integrations

Integrate once, accept everywhere – UPI, cards, net banking, wallets, and more.

Focus on growing your business,

not managing transactions

Optimize transactions

- AI-driven smart routing educes failures.

Scale with confidence

- Secure, compliant, and built for high performance.

Trusted By Businesses

Whether you’re a startup, an enterprise, or a financial institution, we offer enterprise payment solutions tailored to meet your unique payment needs.