Edit Content

Explore India’s first payment ecosystem that allows businesses to transact with multiple payment services and drive unlimited revenue digitally.

Explore India’s first payment ecosystem that allows businesses to transact with multiple payment services and drive unlimited revenue digitally.

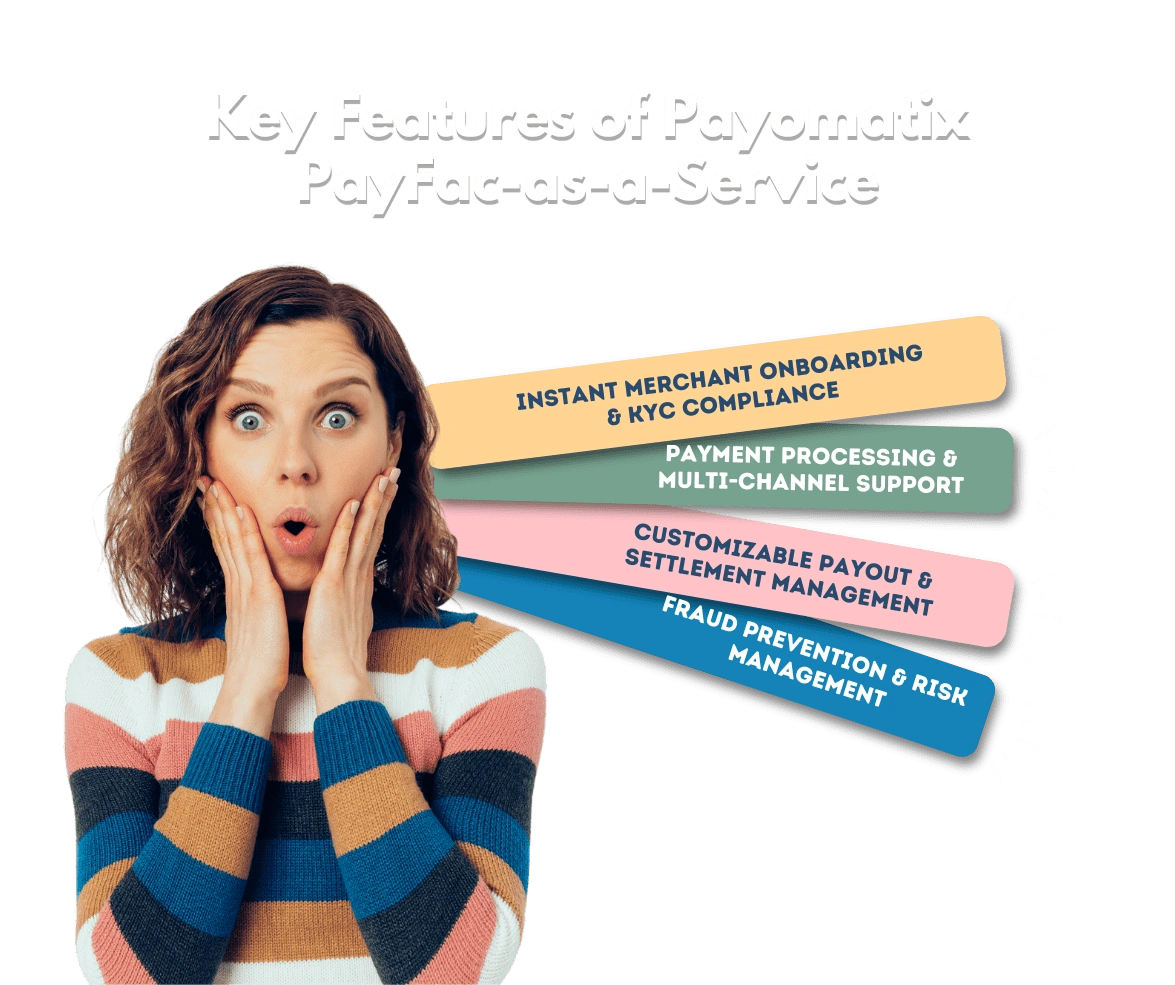

With Payomatix’s PayFac-as-a-Service, businesses can onboard merchants, process payments instantly, manage transactions, and offer embedded financial services—all under their own brand.

PayFac as a Service (Payment Facilitator as a Service) from Payomatix enables ISVs (Independent Software Vendors), SaaS providers, marketplaces, and enterprises to become their own payment facilitators (PayFacs)—without the need for complex compliance, banking partnerships, or infrastructure development.

Automate sub-merchant approvals within minutes, reducing friction.

Handle multi-channel payments (UPI, Cards, Net Banking, Wallets, EMI, BNPL) effortlessly.

Monetize payments by earning processing fees from transactions.

Ensure PCI-DSS, RBI, and NPCI compliance without legal complexities.

Offer branded payment experiences while Payomatix manages backend operations.

PayFac model eliminates the need for businesses to invest in expensive infrastructure.

Offer integrated payments directly within your software.

Onboard sellers and vendors effortlessly.

Launch branded payment solutions with zero infrastructure hassle.

Automate freelancer/worker payouts.